Ubiquiti (UI)·Q2 2026 Earnings Summary

Ubiquiti Crushes Q2 FY2026: Revenue Surges 36%, Stock Jumps 10%

February 6, 2026 · by Fintool AI Agent

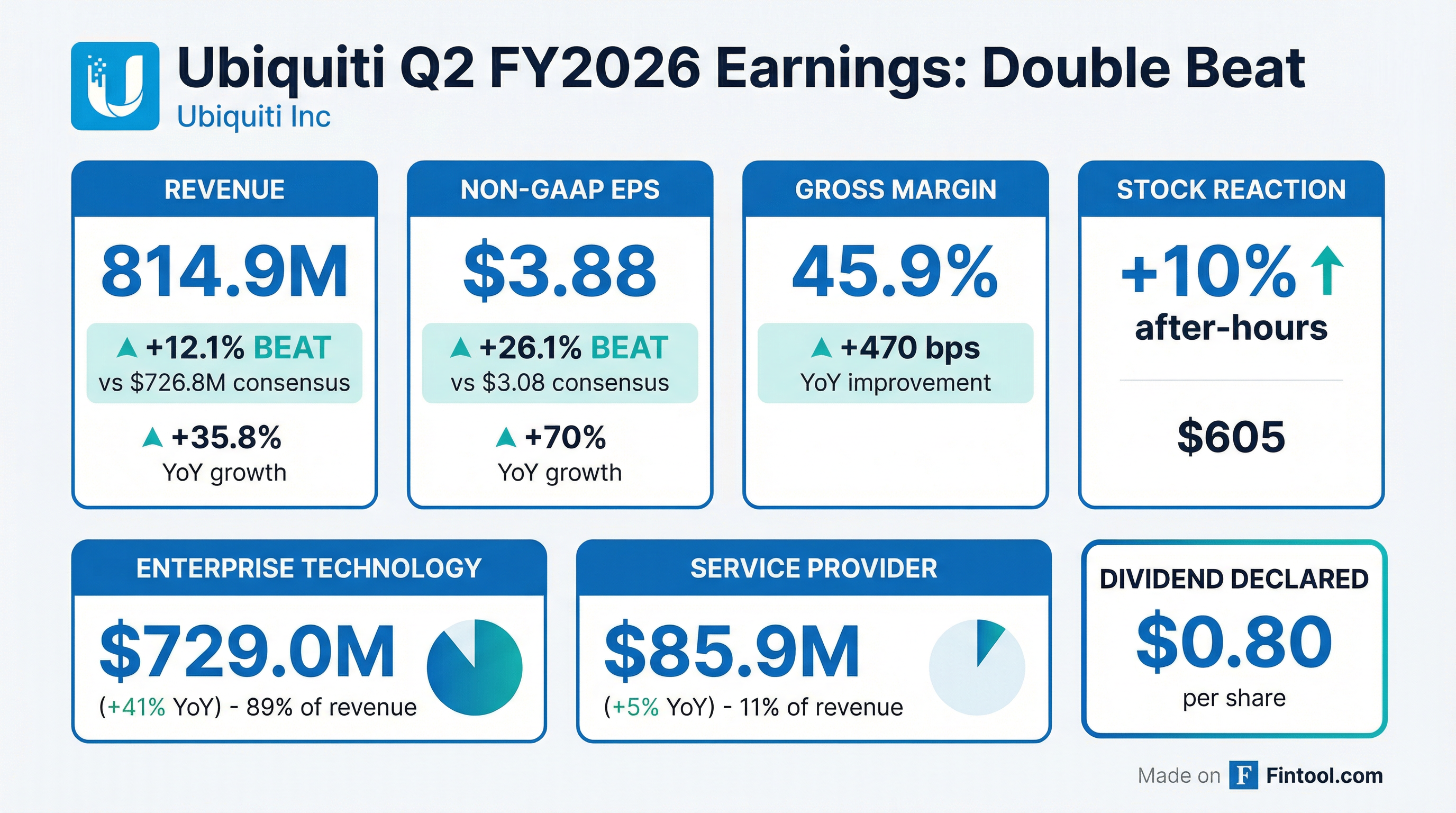

Ubiquiti Inc. (NYSE: UI) delivered a blowout Q2 FY2026, reporting record revenues of $814.9 million—up 35.8% year-over-year and 11.1% sequentially—crushing analyst expectations by over 12%. Non-GAAP EPS of $3.88 beat consensus by 26%, driven by explosive growth in Enterprise Technology and significant gross margin expansion. Shares surged approximately 10% in after-hours trading to $605.

Did Ubiquiti Beat Earnings?

Ubiquiti delivered a decisive double beat on both revenue and earnings:

This continues Ubiquiti's impressive beat streak. The company has consistently exceeded expectations over the past several quarters, with accelerating revenue growth from 18% YoY in Q2 FY25 to nearly 36% YoY this quarter.

What Changed From Last Quarter?

Several notable improvements drove the outperformance:

Revenue Acceleration: Revenue grew 11.1% sequentially (vs 10.8% QoQ last quarter), with both segments contributing to growth.

Gross Margin Stability: Gross margin held steady at 45.9%, down just 10 bps from Q1 FY26's 46.0%, but up 470 bps from the year-ago period. Management noted the marginal decline was driven by product mix, holiday pricing, and higher shipping costs, partially offset by lower indirect costs.

Operating Leverage: Despite higher R&D ($50.8M vs $48.5M) and SG&A ($30.3M vs $27.1M), operating income grew 12% sequentially to $292.9M as revenue growth outpaced expense increases.

Interest Expense Plunge: Interest expense dropped to $1.6M from $3.2M last quarter and $11.4M a year ago, reflecting lower borrowings and interest rates.

Segment Performance

Enterprise Technology continues to dominate, now accounting for 89% of total revenue:

The Enterprise Technology platform—which includes UniFi networking products for businesses—has been the key growth driver, adding over $210M in incremental revenue YoY. This segment benefits from Ubiquiti's strategy of offering professional-grade networking equipment at consumer-friendly price points.

Geographic Breakdown

Growth was broad-based across all regions:

North America represents 54% of revenue and led growth at nearly 38% YoY, suggesting strong demand from U.S. enterprises adopting Ubiquiti's UniFi platform.

Margin Trends: A Multi-Quarter View

Ubiquiti's profitability transformation over the past two years has been remarkable:

Gross margin has expanded over 1,000 basis points from the Q3 FY24 trough of 35.3% to the current 45.9%, driven by favorable product mix shifts toward higher-margin Enterprise products, lower shipping costs, and reduced excess inventory charges.

Capital Allocation

The Board declared a $0.80 per share quarterly dividend, payable February 23, 2026 to shareholders of record as of February 17, 2026. At current prices around $600, this represents an annualized dividend yield of approximately 0.5%.

Ubiquiti's capital-light model and minimal share count (~60.5M diluted shares) continue to drive exceptional per-share earnings growth, with Non-GAAP EPS up 70% YoY.

How Did the Stock React?

UI shares responded strongly to the earnings beat:

The stock is now up approximately 127% from its 52-week low of $255, reflecting the dramatic improvement in fundamentals over the past year.

Risk Factors

Management highlighted several risks in their forward-looking statements:

- Tariff exposure: U.S. tariffs could impact operations and financial results

- Geopolitical risks: Tensions between China and Taiwan, and the Russia-Ukraine conflict

- Distributor reliance: Dependence on a limited number of distributors

- Supply chain: Contract manufacturers and chipset suppliers could face constraints

- Competition: New market entrants may be more established in certain segments

There's also an ongoing investor alert from Scott+Scott Attorneys regarding potential securities claims, though no details on the specific allegations were available in recent filings.

What to Watch Going Forward

-

Enterprise Technology momentum: Can the 41% YoY growth rate sustain as the segment scales past $700M/quarter?

-

Gross margin durability: Management noted holiday pricing and shipping cost headwinds—will these normalize in Q3?

-

Service Provider recovery: At just 5% YoY growth, this legacy segment continues to lag—any signs of acceleration?

-

Interest expense: With debt reduction driving I&O down 86% YoY, how much further can this tailwind contribute?

Bottom Line

Ubiquiti delivered a standout quarter with record revenue, massive beats on both top and bottom line, and continued gross margin expansion. The Enterprise Technology segment is firing on all cylinders, and the company's lean operating model is translating revenue growth into outsized earnings gains. With the stock up 10% after-hours and trading at new multi-month highs, the market is clearly rewarding execution.

Explore Ubiquiti's profile or read the full 8-K filing.